Some Ideas on Hard Money Atlanta You Need To Know

Wiki Article

How Hard Money Atlanta can Save You Time, Stress, and Money.

Table of ContentsMore About Hard Money AtlantaGetting The Hard Money Atlanta To WorkWhat Does Hard Money Atlanta Mean?How Hard Money Atlanta can Save You Time, Stress, and Money.How Hard Money Atlanta can Save You Time, Stress, and Money.

A specific funding barrier is still required. Hard money loans, often referred to as swing loan, are temporary borrowing instruments that actual estate financiers can make use of to fund an investment task. This kind of loan is usually a device for house fins or actual estate designers whose objective is to renovate or establish a home, then sell it for an earnings. There are two key disadvantages to think about: Difficult money financings are hassle-free, yet investors pay a price for obtaining by doing this. The rate can be as much as 10 percent factors greater than for a traditional lending. Origination charges, loan-servicing charges, and closing costs are likewise likely to set you back financiers more.

Some Ideas on Hard Money Atlanta You Need To Know

You may have the ability to customize the payment schedule to your requirements or get particular costs, such as the source cost, minimized or removed during the underwriting procedure. With a difficult money funding, the residential or commercial property itself normally serves as collateral for the funding. However again, lending institutions might permit investors a bit of freedom below.

Tough cash finances are a great fit for rich capitalists that require to get funding for a financial investment home quickly, with no of the bureaucracy that goes along with bank financing (hard money atlanta). When evaluating difficult cash lending institutions, pay attention to the charges, rates of interest, and also funding terms. If you wind up paying way too much for a difficult cash finance or reduce the repayment period also short, that can influence how rewarding your realty venture is in the long term.

If you're looking to purchase a home to turn or as a rental home, it can be testing to obtain a conventional home mortgage - hard money atlanta. If your credit rating isn't where a conventional lending institution would certainly like it or you require cash quicker than a lender has the ability to provide it, you can be unfortunate.

The Best Strategy To Use For Hard Money Atlanta

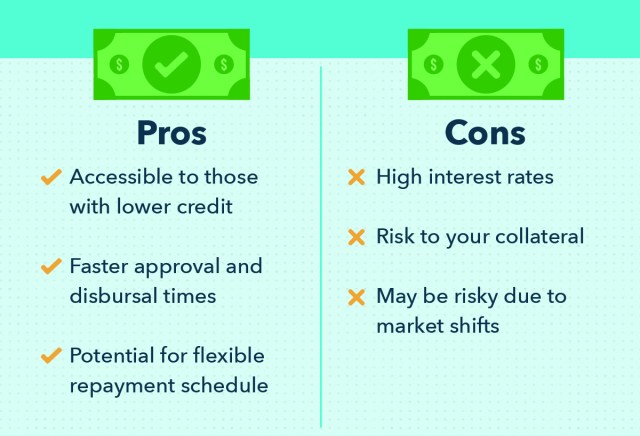

Difficult money fundings are temporary safe finances that utilize the residential or commercial property you're purchasing as security. You won't find one from your bank: Hard cash lendings are provided by alternative loan providers such as private financiers and also private companies, who typically forget mediocre credit report and other financial elements and rather base their choice on the property to be collateralized.Difficult money finances give several benefits for customers. These consist of: Throughout, a tough cash finance may take simply a couple of days. Why? Tough cash lending institutions have a tendency to position more weight on the worth of a home made use of as security than on a borrower's financial resources. That's because difficult money loan providers aren't required to comply with the very same guidelines that typical lenders are.

While hard cash fundings come with advantages, a debtor should likewise think about the dangers. Amongst them are: Tough money lending institutions generally bill a greater passion rate because they're presuming more risk than a traditional lender would certainly.

Some Of Hard Money Atlanta

Every one of that amounts to indicate that a hard cash funding can be an expensive way to obtain money. hard money atlanta. Deciding whether to obtain a tough money lending depends in large part on your circumstance. Regardless, be sure you consider the risks and also the costs before you join the dotted line for a difficult money loan.You absolutely do not intend to lose the loan's collateral due to the fact that you weren't able to stay up to date with the monthly repayments. In enhancement to shedding the from this source possession you advance as security, back-pedaling a hard money financing can result in significant credit history harm. Both of these end results will certainly leave you worse off economically than you remained in the first placeand may make it much harder to obtain once again.

The smart Trick of Hard Money Atlanta That Nobody is Discussing

It is very important to consider variables such as the loan provider's credibility and rate of interest. You may ask a trusted actual estate agent or a fellow residence fin for referrals. Once you have actually pin down the appropriate hard cash lending institution, be prepared to: Develop the down settlement, which usually is heftier than the deposit for a typical home loan Collect the needed paperwork, such as evidence of income Potentially work with an attorney to look at the regards to the funding after you have actually been authorized visit this web-site Map out a strategy for paying off the loan Equally as with any type of loan, examine the benefits and drawbacks of a tough money funding prior to you commit to borrowing.Despite what kind of car loan you pick, it's probably a great concept to inspect your free credit history and complimentary credit rating report with Experian to see where your financial resources stand.

When learn the facts here now you hear the words "difficult cash lending" (or "private money finance") what's the initial point that undergoes your mind? Shady-looking lenders who conduct their business in dark streets and also charge overpriced rate of interest rates? In previous years, some negative apples tainted the difficult cash offering market when a few predacious loan providers were trying to "loan-to-own", supplying really risky loans to consumers using genuine estate as collateral and meaning to foreclose on the buildings.

Report this wiki page